Global Direct General Insurance Carriers

Global Market Research and Industry Report

8 November 2007

Industry Code : J5612

This industry comprises establishments primarily engaged in initially underwriting (i.e., assuming the risk and assigning premiums) various types of insurance policies (except life, disability income, accidental death and dismemberment, and health and medical insurance policies), referred to as general insurance or property/casualty insurance. Industry participants generally assumes risks associated with the loss of or damage to the property of individuals, corporations, and other institutional clients for an annual fee or premium. Also included in this industry are insurance carriers assuming casualty risks, except life, disability, and accidental death and dismemberment insurance. Industry participants also assume risks associated with mortgages, other real estate-related risks, such as title insurance, and other warranty risks. Property/casualty insurance covers the property and liability losses of businesses and individuals. These losses range from damage and injuries resulting from car accidents to the cost of lawsuits stemming from faulty products and professional misconduct. In terms of premiums written, private auto insurance is by far the largest single line, followed by homeowners multiple peril. Property/casualty insurance companies tend to specialize in commercial or personal insurance, but some sell both, and a number of companies are expanding into other financial services sectors, including personal banking and mutual funds.

The major products and services in this industry are:

| - | Private passenger auto insurance |

| - | Fire, allied, and multiple peril insurance |

| - | Workers' compensation insurance |

| - | Commercial auto insurance |

| - | All other property and casualty insurance |

| - | Other liability insurance |

| - | Inland marine insurance |

| - | Mortgage guarantee insurance |

| - | Medical malpractice insurance |

| - | Surety insurance |

| - | Product liability insurance |

| - | Ocean marine insurance | |

The primary activities of this industry are:

| - | Automobile insurance carriers, direct |

| - | Bank deposit insurance carriers, direct |

| - | Mortgage guaranty insurance carriers, direct |

| - | Property and casualty insurance carriers, direct |

| - | Title insurance carriers, real estate, direct |

| - | Warranty insurance carriers (e.g., appliance, automobile, homeowners, product), direct | |

IBISWorld research reports contain trend analysis, statistics, market size information, industry growth rates as well as market share of competitors.

Major market segments are identified and also those forces affecting demand and supply within the industry. Performance analysis includes emerging industry trends as well as recent results and performance of each key company. Drawing on the depth of information IBISWorld also provides 5 year forecasts for each industry.

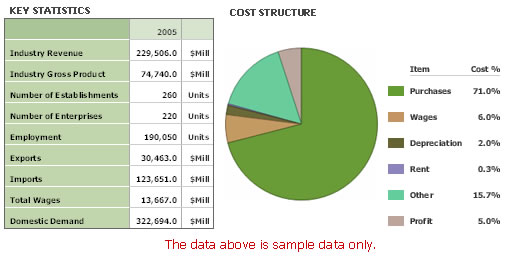

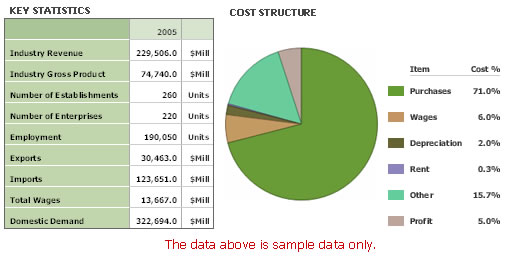

Each comprehensive study also examines details such as the barriers to entry, operating cost structure, technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic regional data.

Each comprehensive study also examines details such as the barriers to entry, operating cost structure (including averages), technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic location.

|

|

|

|