Other Financial Vehiclesin USA

USA Market Research and Industry Report

18 September 2007

Industry Code : 52599

This industry comprises legal entities (i.e., funds (except insurance and employee benefit funds; open-end investment funds; estates and agency accounts; and Real Estate Investment Trusts - REITs)). Included are entities issuing collateralized mortgage obligations (CMOs). A CMO is a form of derivative security backed by a portfolio of mortgage loans. In general, the holder of a CMO owns the rights to receive interest and principal payments from outstanding debt. CMOs are backed by a pool of mortgage-backed securities (MBS) or mortgage loans themselves. These securities were developed to offer a wider range of investment time frames and greater cash flow certainty than was typically available with original MBS. These entities pool mortgages with similar characteristics, and finance their activities by issuing mortgage-backed securities. The goal is to produce a bond-like investment product that fits investors' needs better than direct participation in the loans. Issuers create different tranches by restructuring the principal and interest payments of the loans. A tranche constitutes a class of bondholders with similar maturities. A CMO can be made up of a number of different tranches, where bondholders will receive payments, either interest only, interest and principal or principal only payments, at different maturities depending on the life of the underlying loan and the type of CMO tranche held. By subscribing to a specific tranche, investors can therefore time the start of repayments on their invested funds. If an investor buys a CMO tranche that specifies payments will not be made until ten years into the life of a thirty-year mortgage, the investor will not receive any income from the CMO until ten years has passed. Also included in the industry are closed-end funds, a type of investment company that issues a fixed number of shares that are listed on a stock exchange or traded in the over-the-counter market. Finally, the industry comprises unit investment trusts (UIT), which is a registered investment company that buys and holds a generally fixed portfolio of stocks and bonds. Units in the trust are sold to investors who receive their proportionate share of dividends on interest paid by the UIT investments.

The major products and services in this industry are:

| - | Planned Amortization Class Tranches |

| - | Targeted Amortization Class Tranches |

| - | Domestic Closed-End Investment Funds |

| - | Companion Tranches |

| - | Z-Tranches |

| - | Floating-Rate Tranches |

| - | Residuals |

| - | Tax-Free Debt Unit Investment Trusts |

| - | Equity Unit Investment Trusts |

| - | Principal Only Securities |

| - | Interest Only Securities |

| - | Foreign Closed-End Investment Funds |

| - | Global Closed-End Investment Funds |

| - | Taxable Unit Investment Trusts | | |

The primary activities of this industry are:

| - | Closed-end investment funds (except REITs) |

| - | Collateralized Mortgage Obligations (CMOs) |

| - | Face-amount certificate funds |

| - | Closed-end money market mutual funds |

| - | Closed-end mutual funds |

| - | Profit-sharing funds |

| - | Real estate mortgage investment conduits (REMICs) |

| - | Special purpose vehicles |

| - | Unit investment trust funds | |

IBISWorld research reports contain trend analysis, statistics, market size information, industry growth rates as well as market share of competitors.

Major market segments are identified and also those forces affecting demand and supply within the industry. Performance analysis includes emerging industry trends as well as recent results and performance of each key company. Drawing on the depth of information IBISWorld also provides 5 year forecasts for each industry.

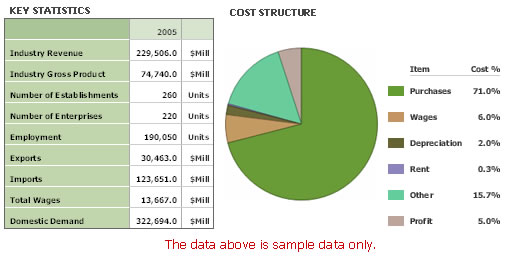

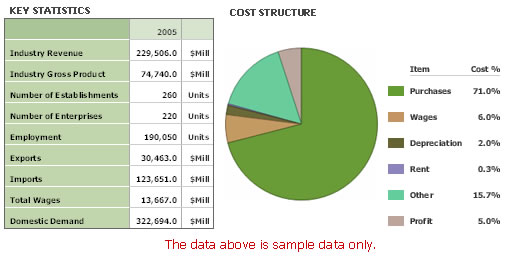

Each comprehensive study also examines details such as the barriers to entry, operating cost structure, technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic regional data.

Each comprehensive study also examines details such as the barriers to entry, operating cost structure (including averages), technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic location.