Real Estate Investment Trustsin USA

USA Market Research and Industry Report

15 June 2007

Industry Code : 52593

This industry comprises legal entities that are Real Estate Investment Trusts (REITs). These are establishments primarily engaged in closed-end investments in real estate or related mortgage assets operating so that they could meet the requirements of the Real Estate Investment Trust Act of 1960 as amended. This act exempts trusts from corporate income and capital gains taxation, providing they invest primarily in specified assets, pay out most of their income to shareholders, and meet certain requirements regarding the dispersion of trust ownership. Closed-end funds have a fixed number of shares outstanding, issued to the public in an initial public offering. After the initial offering, shares in the fund are bought and sold on a securities exchange. Closed-end funds are not obligated to redeem outstanding shares like open-end investment funds are. Consequently, the price of a share in a closed-end fund is determined entirely by market forces. A REIT is, simply put, a company dedicated to owning and, in most cases, operating income-producing real estate, such as apartments, shopping centers, offices and warehouses. Some REITs are also engaged in financing real estate. Most importantly, a REIT is legally required to pay virtually all of its taxable income (90 percent) to its shareholders every year.

The major products and services in this industry are:

| - | Industrial/Office Property |

| - | Retail Property |

| - | Residential Property |

| - | Diversified Property |

| - | Health Care Property |

| - | Lodging/Resort Property |

| - | Mortgage Backed Property |

| - | Specialty Property |

| - | Self Storage Property | | |

The primary activities of this industry are:

| - | Real estate investment trusts (REITs) |

| - | Equity REITs |

| - | Hybrid REITs |

| - | Mortgage REITs | |

IBISWorld research reports contain trend analysis, statistics, market size information, industry growth rates as well as market share of competitors.

Major market segments are identified and also those forces affecting demand and supply within the industry. Performance analysis includes emerging industry trends as well as recent results and performance of each key company. Drawing on the depth of information IBISWorld also provides 5 year forecasts for each industry.

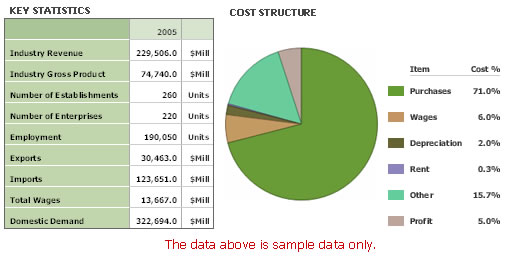

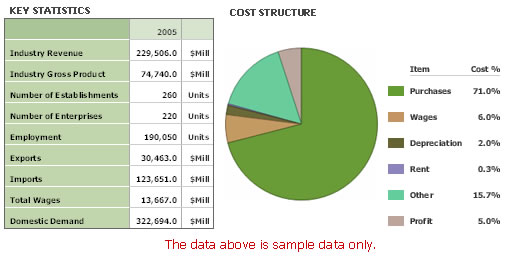

Each comprehensive study also examines details such as the barriers to entry, operating cost structure, technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic regional data.

Each comprehensive study also examines details such as the barriers to entry, operating cost structure (including averages), technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic location.