Commodity Contracts Dealingin USA

USA Market Research and Industry Report

17 August 2007

Industry Code : 52313

This industry comprises establishments primarily engaged in acting as principals (i.e., investors who buy or sell for their own account) in buying or selling spot or futures commodity contracts or options, such as precious metals, foreign currency, oil, or agricultural products, generally on a spread basis. Spreaders enter into contracts with the hope of profiting from an expected change in price relationships. There are a number of different types of spreads. For example, a speculator may purchase (go long in) a contract expiring in one contract month and sell (short, or go short in) another contract on the same underlying security expiring in a different month, also called "calendar spreads." Spreaders may purchase and sell the same contract month in two different but economically correlated security futures contracts. If a speculator believes that one underlying security will have a stronger growth than another underlying security over a certain time period, the spreader may purchase the former security and sell the latter, both with expiration at the end of the time period. Lastly, speculators may engage in arbitrage, which is similar to spreads except that the long and short positions occur on two different markets. This position can be established by taking an economically opposite position in a security futures contract on another exchange, in an options contract, or in the underlying security.

The major products and services in this industry are:

| - | Trading derivatives instruments, own account |

| - | Brokering and dealing other financial instruments |

| - | Brokering and dealing futures, exchange traded |

| - | Trading other security and commodity contracts, own account |

| - | Securities and commodities contract trade execution, clearing and |

| - | Trading foreign currency, own account |

| - | Brokering and dealing foreign currency, wholesale |

| - | Brokering and dealing equities |

| - | Payment clearing and settlement fees |

| - | Other |

| - | Brokering and dealing options, exchange traded | |

The primary activities of this industry are:

| - | Commodity contract trading companies |

| - | Commodity contracts dealing (i.e., acting as a principal in dealing commodities to investors) |

| - | Commodity contracts floor traders (i.e., acting as a principal in dealing commodities to investors) |

| - | Commodity contracts floor trading (i.e., acting as a principal in dealing commodities to investors) |

| - | Commodity contracts options dealing (i.e., acting as a principal in dealing commodities to investors) |

| - | Commodity contracts traders (i.e., acting as a principal in dealing commodities to investors) |

| - | Foreign currency exchange dealing (i.e., acting as a principal in dealing commodities to investors) |

| - | Foreign currency exchange services (i.e., selling to the public) |

| - | Futures commodity contracts dealing (i.e., acting as a principal in dealing commodities to investors) |

| - | Trading companies, commodity contracts | |

IBISWorld research reports contain trend analysis, statistics, market size information, industry growth rates as well as market share of competitors.

Major market segments are identified and also those forces affecting demand and supply within the industry. Performance analysis includes emerging industry trends as well as recent results and performance of each key company. Drawing on the depth of information IBISWorld also provides 5 year forecasts for each industry.

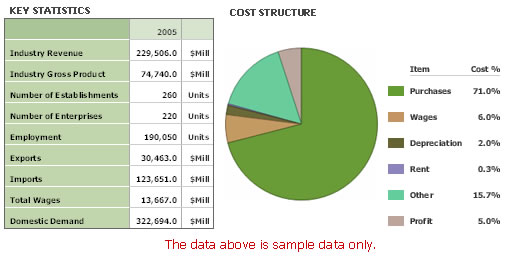

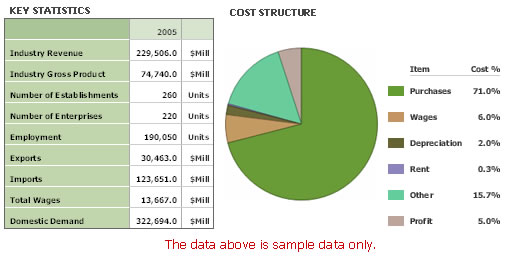

Each comprehensive study also examines details such as the barriers to entry, operating cost structure, technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic regional data.

Each comprehensive study also examines details such as the barriers to entry, operating cost structure (including averages), technology & systems and domestic & international markets. Tables and statistics include: Industry revenue, exports, imports, wages and number of companies in the industry, Industry growth and geographic location.

|

|

|

|